Frequently Asked Questions about NY PIP

The term "unloaded" is not specifically defined. N.Y. Ins. Law § 5105(a) simply states the right to recover exists only if at least one of the motor vehicles involved is a motor vehicle weighing more than 6,500 pounds unloaded. This is commonly accepted to mean the actual weight of the vehicle excluding any item that is made part of the vehicle and excluding anything it was carrying or hauling. Regarding the evidence a party may submit to prove a vehicle's weight, the various accepted proof of unloaded weight includes but is not limited to: the vehicle VIN information from the Department of Motor Vehicles - as it provides the unloaded weight as opposed to the plate information which may be the gross maximum vehicle weight; a Certificate of Title or Certificate of Origin; a weight certificate from an official weighing station; Red Book or Blue Book information.

No. Per a NYSID Office of General Counsel opinion dated July 24, 2006, an insurer may not combine the weight of the motor vehicle and a trailer in order to qualify for the 6,500 pound limit requirement, which would allow transfer of loss to the insurer of the at-fault vehicle.

A vehicle for hire is a motor vehicle "used principally for the transportation of persons or property for hire" within the meaning of N.Y. Ins. Law § 5105(a) (McKinney 2000). This includes vehicles hired to transport people, such as taxis and buses, and vehicles hired to transport property, such as a tow truck. Rental U-Haul trucks are not included. See NYSID Office of General Counsel opinion dated May 2, 2001.

No. Per a NYSID Office of General Counsel opinion dated May 2, 2001, such a motor vehicle is not a motor vehicle "used principally for the transportation of persons or property for hire" within the meaning of N.Y. Ins. Law § 5105(a) (McKinney 2000), notwithstanding the fact that the owner charges its customers a fee for the delivery.

N.Y. Insurance Law § 5105 (a) provides that a PIP carrier or Workers' Compensation carrier may recover against a responsible party provided one of the motor vehicles involved in the accident weighs over 6,500 pounds unloaded or is a vehicle for hire. Involved means "part of or included in the accident" so the vehicle that is over 6,500 pounds or a vehicle for hire need not be the applicant or the respondent (Travelers Property V Allstate, 670 N.Y.S.2d. 959 (1998)). If the filing party asserts that an involved vehicle weighed more than 6,500 pounds or is a vehicle for hire (i.e. a taxi cab cut off one vehicle causing it to strike another vehicle), or the responding company asserts an affirmative defense objecting to jurisdiction on the grounds that no involved vehicle weighed more than 6,500 pounds or is a vehicle for hire, the arbitrator will render a decision on this issue based on the evidence submitted to support the respective contentions.

A Workers' Compensation provider cannot be a responding company in the mandatory No-Fault Inter Company Arbitration program (NY PIP). New York State Insurance Law Section 65.15 (1)(n)(viii) of Regulation 68 indicates that if a claimant is eligible for workers' compensation then said compensation provider shall serve as the sole provider of benefits. A Workers' Compensation provider may be a recovering company for Loss Transfer and seek recovery of its payments.

Yes, per the NYSID Office of General Counsel opinion dated September 9, 2009, an entity that has, pursuant to the New York Vehicle & Traffic Law ("VTL"), registered the motor vehicle with proper proof of financial security, that indicates that the entity is self-insured with respect to the vehicle, is the appropriate party to a loss transfer inter-company arbitration if the amount at issue wholly falls within the retention amount. If arbitration is filed against a liability insurer, the insurer would be free to assert a jurisdictional exclusion (Subrogation Prohibited) and submit evidence that proves the motor vehicle is registered as self-insured. If the motor vehicle is not registered as self-insured, then the liability insurer is the appropriate party to the arbitration. (Liability deductibles or policy limits do not apply.)

The Motor Vehicle Accident Indemnification Corporation (MVAIC) was established to pay bodily injury damages and no-fault benefits to "covered" victims of motor vehicle accidents caused by uninsured motorists. Visit www.mvaic.com for more information.

The following information regarding policy cancellations in New York was provided by MVAIC:

Policy cancellations should be in STRICT compliance with Vehicle and Traffic Law 313.

For assigned risk policies, the notice should contain the "the right to review phrase".

Reference: Vehicle and Traffic Law 313, Part 34 Motor Vehicle Liability Insurance Reporting New York Automobile Insurance Plan Manual.

NY Policy Cancellation by Premium Finance Company Requirements:

Reference: Banking Law 576

Out-of-State cancellation notice should be in compliance with each state regulation

The following information regarding policy cancellations in New York was provided by MVAIC:

Policy cancellations should be in STRICT compliance with Vehicle and Traffic Law 313.

- DMV filing: 30 days following the effective date of cancellation. The proof of DMV filing, if not reflected in the DMV Expansion, should come from the Department of Motor Vehicle, and not from the Insurance carriers' computer print-outs.

- Mailing requirements: Should have a postal stamp. Should be mailed 15 days before the cancellation for non-payment of premium; 20 days before for policy cancellation for other than non-payment of premium.

- There should be correct financial security language.

For assigned risk policies, the notice should contain the "the right to review phrase".

Reference: Vehicle and Traffic Law 313, Part 34 Motor Vehicle Liability Insurance Reporting New York Automobile Insurance Plan Manual.

NY Policy Cancellation by Premium Finance Company Requirements:

- 10-Days Notice of Intent to Cancel - with stamped proof of mailing

- Cancellation notice - with stamped proof of mailing

Reference: Banking Law 576

Out-of-State cancellation notice should be in compliance with each state regulation

- Mailing requirements

- Filing with DMV or Registry of Motor Vehicle

The New York Motor Vehicle No-Fault Insurance Law cover letter (NYS Form NF-1A Rev 1/2004) specifically states: "b. 80% of lost earnings up to a maximum monthly payment of $2,000 for up to three years following the date of the accident."

The only other circumstance would be where the responding company does not assert the jurisdictional exclusion (Subrogation Prohibited). Otherwise, arbitration is not mandatory for claims involving carriers or self-insureds that do not do business in New York (see NYSID Office of General Counsel opinion dated March 31, 2004). It should also be noted that following the enactment of the No-Fault laws, a number of non-resident insurers, who do not do business in New York State, executed waivers with the New York State Department of Motor Vehicles, subjecting themselves to New York law and jurisdiction should one of their vehicles come into New York State and be involved in an accident in this state. To learn if an out-of-state insurance company has executed and filed a Power of Attorney with the New York Department of Motor Vehicles (DMV), an email request should be made directly to dmv.sm.iiesmail@dmv.ny.gov.

For insurers, a printout from the NYDFS Web site that lists those insurers that are authorized to write in NY. On the NYDFS Web site, click the drop-down arrow in the third row for "Company Name from the List" to display the full listing of licensed companies.

For a self-insured, any written documentation from a representative of the company, affirming it does not do business in New York, should be accepted in good faith, i.e., an affidavit from a manager or officer of the corporation.

For a self-insured, any written documentation from a representative of the company, affirming it does not do business in New York, should be accepted in good faith, i.e., an affidavit from a manager or officer of the corporation.

- No, for loss transfer disputes. Yes, for priority of payments disputes.

- Under the appellate division case of Hunter v OOIDA 79AD 3rd 1 (2010), a loss transfer case involving an out-of-state accident cannot be heard in New York due to the wording of Section 5105 which creates that right only when the injured party could have made claim but for provisions of Article 51 of New York insurance law and the case qualifies (an involved vehicle weighs 6,500 lbs or more or is a vehicle for hire). In the case of an out-of-state accident, it is not Article 51 which bars suit as Article 51 has no extraterritorial effect. Therefore the terms of Article 51 do not bar suit even if the other state's laws bar suit. So the accident does not fall within the precise language of Section 5105.

- Priority of payments arbitration is allowed for an out of state accident based upon the ADDITIONAL provision of Section 5105 which requires Intercompany arbitration in a situation in which carriers dispute which coverage is primary. That arbitration does not come under the loss transfer arbitration restrictions. Therefore if two or more NY carriers have a dispute as to which is primary it must be heard in NY priority of payments arbitration.

- See also: the NYSID Office of General Counsel opinion dated April 30, 2003.

Yes, a court order or verdict can be res judicata/collateral estoppel, depending on the particulars of the court order and the information it contains.

A copy of the order deciding the motion for summary judgment or the verdict sheet after trial would be acceptable; an E-law printout would not be acceptable because it does not give details of the suit.

It is not improper to decide liability at 50% against both parties involved in an accident if this is what the evidence supports. What is improper is to render a liability determination of 50% against both parties involved in an accident when liability has not been established against either party - the evidence does not clearly prove the respective driver's negligence to be equal, or the evidence does not clearly prove liability against either party, i.e., all evidence is conflicting and neither party has proven which driver is the cause of the accident.

The burden of proof in intercompany arbitration is "preponderance of the evidence" (civil matters), not the threshold of "beyond a reasonable doubt" (criminal matters). This simply means that the recovering company does not need to provide indisputable proof, i.e., the only possible explanation of what happened, but only needs to show that its factual explanation is more likely true than any other alternative explanations. It also means that all possible alternative explanations need not be specifically ruled out in order for the recovering company to prevail. If the recovering company proves a prima facie case by a preponderance of evidence, you will then review the responding company's answer to determine whether comparative negligence should be applied. The responding company is the party that determines if liability is at issue. If the responding company does not answer, liability must still be proven by the filing party. If the responding party does answer and admits liability, the recovering company only has to prove damages. If a percentage of liability is admitted, you may not award less than that amount.

An Arbitrator has the authority to adjourn a hearing to request evidence that is listed (and implied to be presented) but is not available or for clarification of submitted evidence such as case law, opinions, and proof of damages.

A jurisdictional exclusion is an objection to jurisdiction that, if applicable, will remove the party or filing from arbitration's jurisdiction without a decision on the issues of liability or damages. The type of proof necessary to support a jurisdictional exclusion will vary depending on the exclusion that is asserted. For example, if the respondent asserts a denial of coverage, it must submit a copy of its denial of coverage letter to the party seeking coverage for the accident (i.e., alleged negligent party).

All decisions regarding liability and/or damages are final and binding. The only instance where arbitration can be re-filed after an arbitrator makes a decision would be if the decision was to uphold a jurisdictional exclusion causing the case to be closed for lacking jurisdiction (no decision on liability or damages has been made) and the impediment has been removed. For example, an arbitrator closes an initial filing due to the condition precedent was not satisfied (i.e., the Intercompany Reimbursement Notification was not sent to the Respondent prior to arbitration being filed). The recovering party can send the appropriate Notification to the responding party and then re-file should settlement not be reached (assuming the applicable Statute of Limitations has not lapsed in the interim).

While the rules are silent on this issue, a responding company may not name or add additional responding parties to an arbitration filing. The named responding company may only argue the respective liability of other parties in its liability arguments. The arbitrator will consider all the arguments made and evidence submitted and apportion the liability of the named parties, awarding the amount proven against the named responding companies.

No. Per the Intercompany Reimbursement Notification form only "Basic Benefits" are subject to mandatory arbitration under Section 5105 of the Insurance Law. Only by agreement of the parties can "Additional Benefits" be submitted. See Section 5102 Definitions for the definitions of (a) "Basic economic loss" (1) Medical, (2) Loss of earnings, (3) All other reasonable and necessary expenses. (This does not apply to Priority of Payment disputes.)

No. Per a NYSID Office of General Counsel opinion dated June 16, 2010 and an August 24, 2010 Circular Letter issued by the New York State Insurance Department, an automobile insurer or self-insurer may not offset recovering company's aggregate no-fault benefit limit for the payment of a HCRA surcharge. This applies retroactively regardless of when the surcharge was paid by the automobile insurer or self-insurer.

As a condition precedent to filing arbitration, the recovering company must send the "Inter-Company Reimbursement Notification Form" to the adverse party from which they are requesting reimbursement of its first-party benefits. No other documentation is "required" to be provided prior to arbitration being filed. That said, it is presumed the parties will exchange necessary documentation to facilitate settlement of the claim and submit a matter to inter-company arbitration only after negotiations fail.

There is no similar rule under the NY PIP/Loss Transfer intercompany arbitration procedures. If a responding company does not comply with an award, the recovering company has two options: File a complaint regarding the party's non-payment with the NYS Department of Financial Servies and/or file a motion to enforce the award with the Court. For cases filed in AF’s TRS application, a one-time courtesy Unpaid Award notification is available to send to the non-paying Responding party if the award has not been paid 30 days after the decision publication. The functionality may be found in the Case Overview > Decision Actions.

All arbitration decisions regarding liability and/or damages are final and binding. The only instance where litigation can be filed after an arbitrator makes a decision would be if the decision was to uphold an affirmative defense causing the case to be closed for lacking jurisdiction in inter-company arbitration (no decision on liability or damages is made). For example, an arbitrator closes an arbitration filing due to the affirmative defense that the respondent carrier has denied coverage for the loss to the alleged negligent party seeking coverage under its policy. The applicant would be free to pursue the uninsured driver outside of inter-company arbitration.

Yes. Per a NYSID Office of General Counsel opinion dated August 1, 2003. Because OBEL coverage is an element of basic economic loss and therefore a first party benefit, the insurer of an at-fault vehicle in excess of 6,500 pounds or for hire, is obligated under the statute to provide the full amount of first party benefits paid by the other No-Fault insurer under Section 5105(a) loss transfer, including instances where first party benefits paid include No-Fault OBEL coverage.

Per the New York Insurance Department, the recovery by the pedestrian's vehicle insurer is not based on which vehicle struck the pedestrian or which vehicle is at fault. Under the sources of mandatory personal injury protection benefits provisions of 11 NYCRR 65-3.12, first party benefits paid to the pedestrian would be recoverable from the insurers of vehicle A and vehicle B as both vehicles were being used or operated at the time of the collision. Further, 11 NYCRR 3.12 (e) provides in relevant part that:

"Any insurer paying first-party benefits shall be reimbursed by other insurers for their proportionate share of the costs of the claim and the allocated expenses of processing the claim, in accordance with the provisions entitled "Other coverage" contained in the section 65-1.1...and... "Other sources of first-party benefits" contained in subpart 65-2..."

Accordingly, as there are two sources of first-party benefits available in the above scenario presented, the pedestrian's vehicle insurer would recover 50% from the insurer of vehicle A and 50% from the insurer of vehicle B.

"Any insurer paying first-party benefits shall be reimbursed by other insurers for their proportionate share of the costs of the claim and the allocated expenses of processing the claim, in accordance with the provisions entitled "Other coverage" contained in the section 65-1.1...and... "Other sources of first-party benefits" contained in subpart 65-2..."

Accordingly, as there are two sources of first-party benefits available in the above scenario presented, the pedestrian's vehicle insurer would recover 50% from the insurer of vehicle A and 50% from the insurer of vehicle B.

Loss transfer may not be brought against the insurer of a motorcycle. The owner/operator/passenger of a motorcycle is NOT a covered party pursuant to Section 5103 of the Insurance Law. Section 5105 provides loss transfer only for accidents between "covered" parties. As an aside, arbitration may be filed against a motorcycle insurer under a priority of payments scenario. For example, if a motorcycle hits a pedestrian, the motorcycle must provide PIP to the pedestrian. If the pedestrian's carrier pays him/her PIP they can file a priority of payment claim against the motorcyclist's carrier. Or, if a car and a motorcycle collide and one strikes a pedestrian and one of them pays PIP to the pedestrian, they can seek priority of payment reimbursement pro rata against the other.

- Legal fees are not recoverable in loss transfer arbitration. They are an administrative expense, not a benefit.

- Workers compensation legal fees are recoverable in loss transfer arbitration because unlike PIP they are not an added expense to the paying carrier, they are deducted from the workers' compensation award payable to the injured party.

- Legal fees are recoverable in priority of payment arbitration when they have been incurred as a reasonable and necessary expense in the defense of a PIP denial by the Applicant.

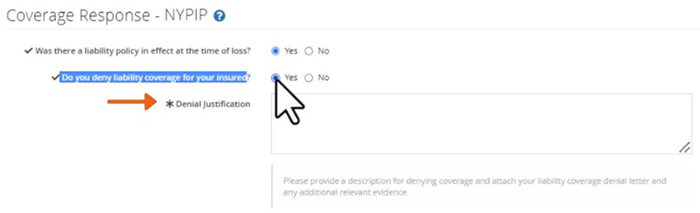

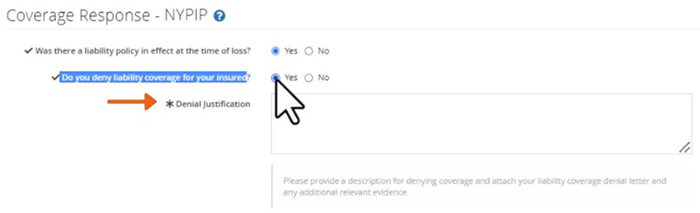

Pursuant to Rule 2 Initiation of Arbitration (v) of the NY PIP Rules, the responding company must:

If these three requirements are met, the responding company will be deemed Out of Jurisdiction. This does not apply to cases filed by MVAIC.

- Select the appropriate option indicating that liability coverage has been denied for the claim in question.

- State the reason for the coverage denial.

- Attach a copy of the denial of liability coverage letter to the party seeking coverage for the loss (i.e., alleged negligent party).

If these three requirements are met, the responding company will be deemed Out of Jurisdiction. This does not apply to cases filed by MVAIC.

No, the issue of an insured's involvement is an issue of fact or liability, not coverage. The Respondent carrier has the duty to defend its insured (i.e., provide coverage). The liability argument of non-involvement is to be presented in the contentions and supported with evidence for the arbitrator's consideration (i.e., the insured's statement or a vehicle log confirming where the vehicle was when the loss occurred). The arbitrator's decision will be neither collateral estoppel nor res judicata to any litigation brought against the insured of the respondent. That said, if litigation is pending, a deferment may be requested.

Yes. Under Sec 227 of the Worker's Compensation Law which is the Disability Benefits Law, a carrier which pays disability can recover its disability payments in a case in which the tortfeasor is a covered person and the accident contains a qualifier as set forth in Sec 5105 of the Insurance Law. The reason is similar to that of a Worker's Comp carrier recovering lost wages-the disability payments are an offset to PIP under Article 51 of the Insurance Law and just as Workers Comp wages are recoverable, disability payments are-subject to their being a qualifier.

No. Although the Federal government vehicle may meet the criteria for "covered" and a qualifying vehicle may be present, the Federal Government may not be brought into a state mandated arbitration proceeding.

No. Additional PIP is not subject to loss transfer pursuant to Section 5105 of the Insurance Law which provides only for mandatory arbitration of basic no fault benefits. Special Arbitration may be used to recover APIP if all parties consent.

No, it is not required. General Municipality Law 50e does not apply and the Statute of Limitations is, as in all other cases, three years from each payment. The New York State Court of Appeals ruled in the case of City of Syracuse v. City of Utica that Article 51 of the Insurance Law is paramount in these cases and the provisions of General Municipality Law and Court of Claims Act requiring notices of claim and setting short statute of limitation do not apply to loss transfer arbitration proceedings.

No. E-law is one form of evidence, but it is not the only acceptable form that can be submitted. A party may submit e-law to support that litigation is still pending. However, the adverse party may submit other forms of evidence to support that the litigation is no longer pending. For example, a Stipulation of Dismissal may have been filed with the court that is not yet reflected in e-law. An arbitrator's decision on whether to grant a deferment, if challenged, will be based on the evidence that best proves the current state of the companion claim or suit.

No. Loss transfer proceedings entail a determination of comparative negligence among the accident participants. In New York, joint and several liability falls under N.Y.C.P.L.R. § 1601. The section specifically relates to situations in which a verdict or a decision is reached in a claim for personal injury. As PIP is separate and distinct from claims for personal injury, it is not applicable. Moreover, joint and several liability applies to situations in which a verdict has already been issued finding joint liability between several tort feasors. As such, a recovering company may not assert joint and several liability in New York Loss Transfer Arbitration. Rather, the recovering company should include all identified parties as Respondents to the arbitration filing for a determination of respective culpabilities.

Pursuant to a June 2016 court decision, it may not. In its decision, the court noted that Insurance Law 5101 pertains to health providers.

All appearances are via conference call. There are no in-person hearings. The intent to appear must be indicated where appropriate when submitting the filing or response. AF will send the call-in information as well as the date and time for the call.

Only one IRN is required for each feature filing that is to be heard.

- If additional payments are made after filing arbitration, but the filing is deferred, the recovering company need only send the original IRN to the responding company.

- If an initial filing is heard/closed, and a supplemental filing is to be submitted to recover additional payments, a new IRN must be sent to the responding company for the supplemental damages.

AF is proud to have served as the inter-company arbitration administrator since the program's inception in the early 1970's. Circular Letter No. 10 (2005) issued May 16, 2005, by the New York Department of Financial Services, reinforces AF's authority as administrator.

- Review the frequently asked questions on the New York State Department of Financial Services website.

- View the New York State Department of Financial Services Circular Letter No. 3, April 12, 2019.

- View the New York State Department of Financial Services Circular Letter No. 4, April 12, 2019.

That is a question the recovering company needs to decide, and it might be best to contact the New York Liquidation Bureau since the liquidation order likely would address claims against a carrier in liquidation. The standard language in every Liquidation Order provides the following relief: “All parties are permanently enjoined and restrained from interfering with the Liquidator or this proceeding, obtaining any preferences, judgments, attachments or other liens, making any levy against (Carrier), its assets or any part thereof, or commencing or prosecuting any action or proceedings against the carrier, the Superintendent as Liquidator of the Carrier, or the New York Liquidation Bureau, or their present or former employees, attorneys or agents, relating to this proceeding or the discharge of their duties under Insurance Law Article 74 and 76.”

The damages sought may include benefits paid under OBEL. The filing company must prove that the injured party meets the definition of an Eligible Injured Party on the responding company’s policy. (Eligibility requirements for the PIP endorsement can be found on page 4 of Regulation 68.) Additionally, there are times when an injured party may be eligible under the policy of multiple responding companies. If they are all New York policies, the damages will be split evenly. If one is an out-of-state policy, the damages would be pro-rated.

Pursuant to New York State Insurance Law §§5202(b) and 5221(b)(1) Motor Vehicle Accident Indemnification Corporation (“MVAIC”) is only authorized to provide PIP benefits to individuals with no available insurance, i.e., “qualified person.” Insurance Law §5105(a) only applies to insurers liable for the payment of first party benefits on behalf of a “covered person.” The availability of no-fault coverage would preclude responsibility for payments by MVAIC under Insurance Law §§5202(b) and 5221(b)(1). Thus, MVAIC can never be a responding company in a mandatory No-Fault Inter Company Arbitration (NY PIP). MVAIC may be a recovering company for Loss Transfer and seek recovery of payments made on behalf of a “qualified person.”